ESG for Selecting Short Or Under-weight Positions with AltData

March 13, 2020

Environmental, Social and Governance (ESG) investing is based on the premise that firms with higher quality management and resources will operate well and their value will rise in the market. The reverse is also true. A negative ESG event for a company can be a precursor to the shares underperforming or decreasing in value.

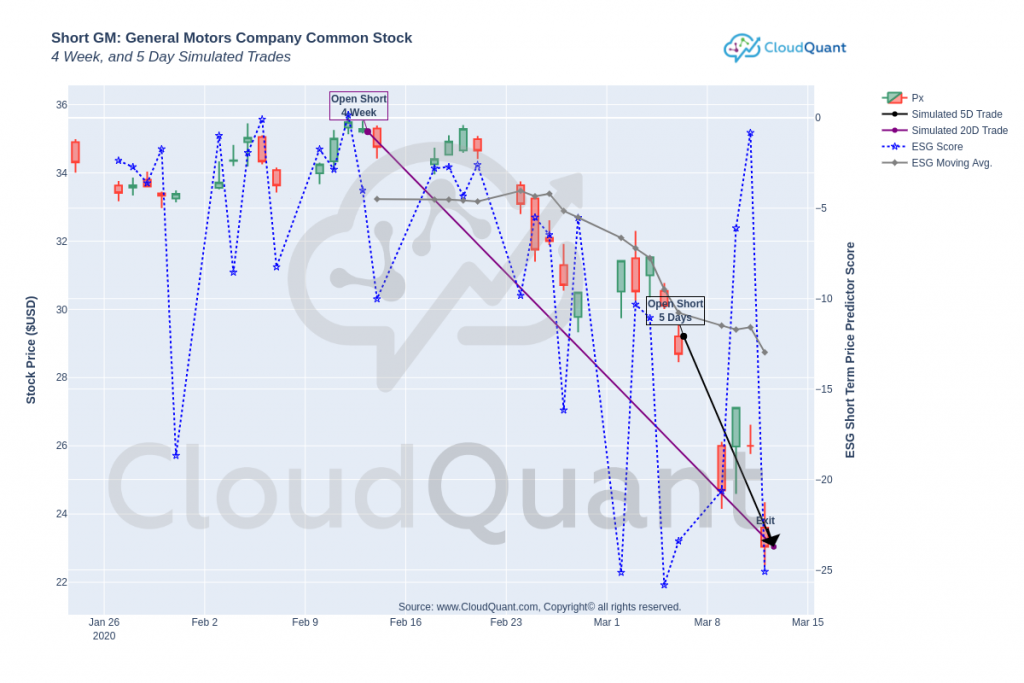

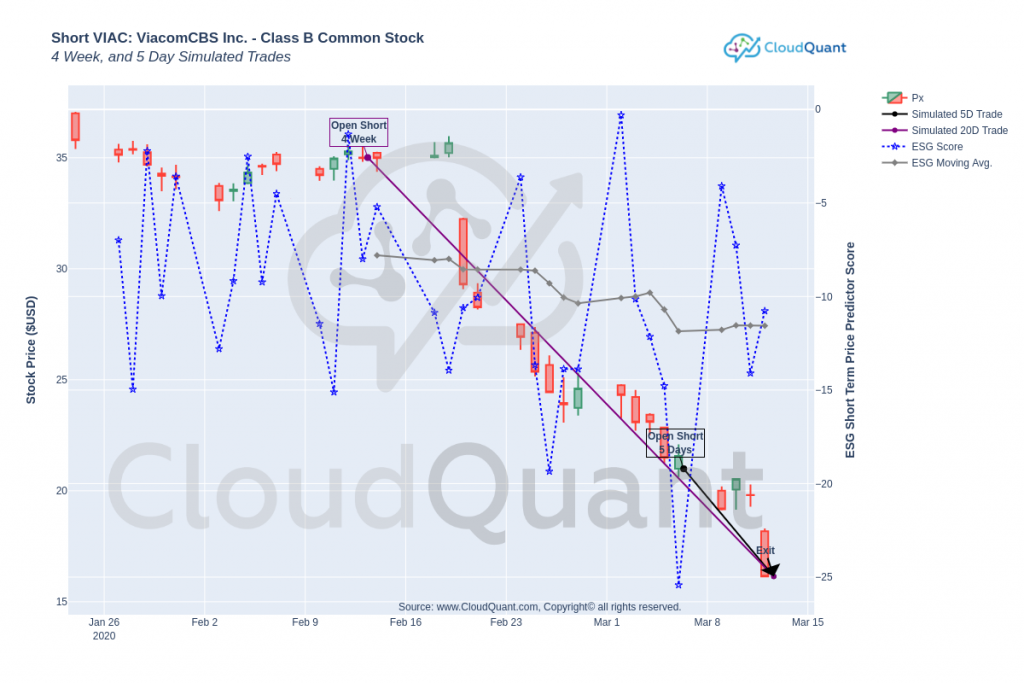

CloudQuant’s research shows that short or under-weight opportunities exist using ESG Alternative Data.

The following charts show some of the short signals of $GM and $VIAC where the GSQ Short Term Price Predictor Score fell to ≈ -25. The trading strategy (source code and white paper available upon request) suggested that a 5-day hold works with Alternative Data.