CloudQuant AlphaFlow Dataset informs traders on the magnitude and direction of order flow. It further decomposes money flow in the equity market into institutional subcomponents. This enables investors and institutional traders to understand short-term price performance, long-term investment trend, and opportunistic price dislocation. By looking at the CloudQuant AlphaFlow Dataset, traders can identify price volatility due to large institutional players.

Create edge with the CloudQuant AlphaFlow Dataset by: monitoring early-morning relative volume and money flow, identifying short and long term price and volume patterns, identifying institutional traders currently driving price movement, and enhance your strategies trade execution. The Dataset contains the results from five (5) institutional flow calculations. This is a 1-minute interval dataset, has historical data back to 2011, and refreshes daily before the market opens.

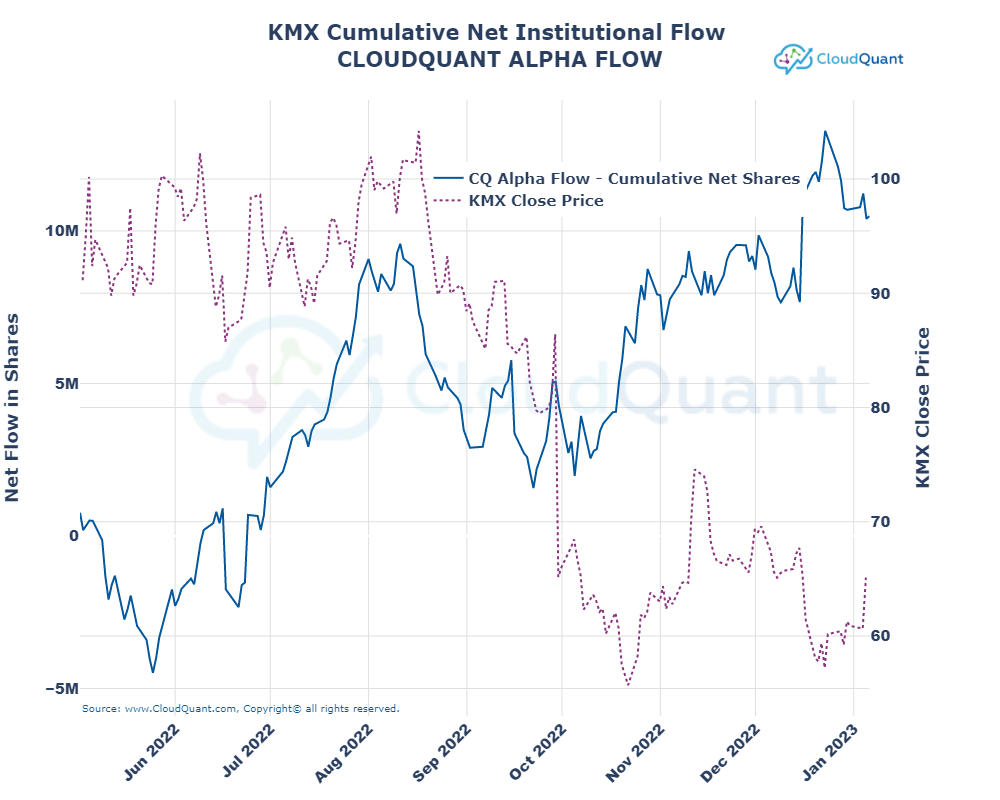

CarMax, Inc NYSE: KMX Close Price vs. CQ Alpha Flow

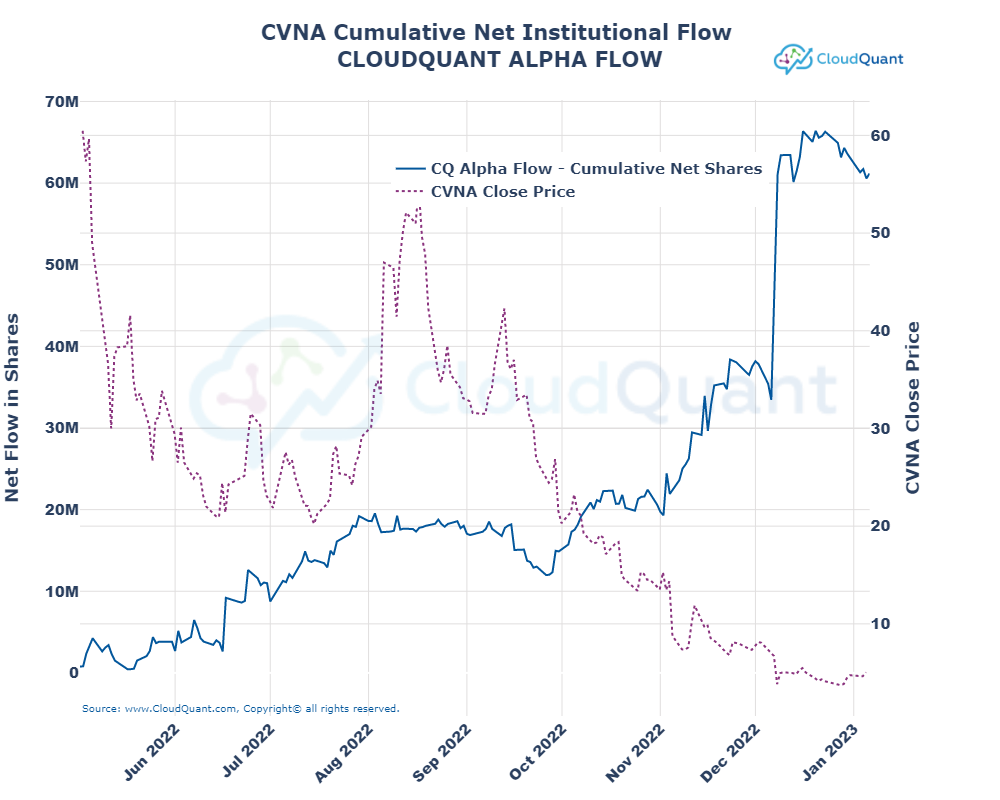

Carvana Co NYSE: CVNA Close Price vs. CQ Alpha Flow

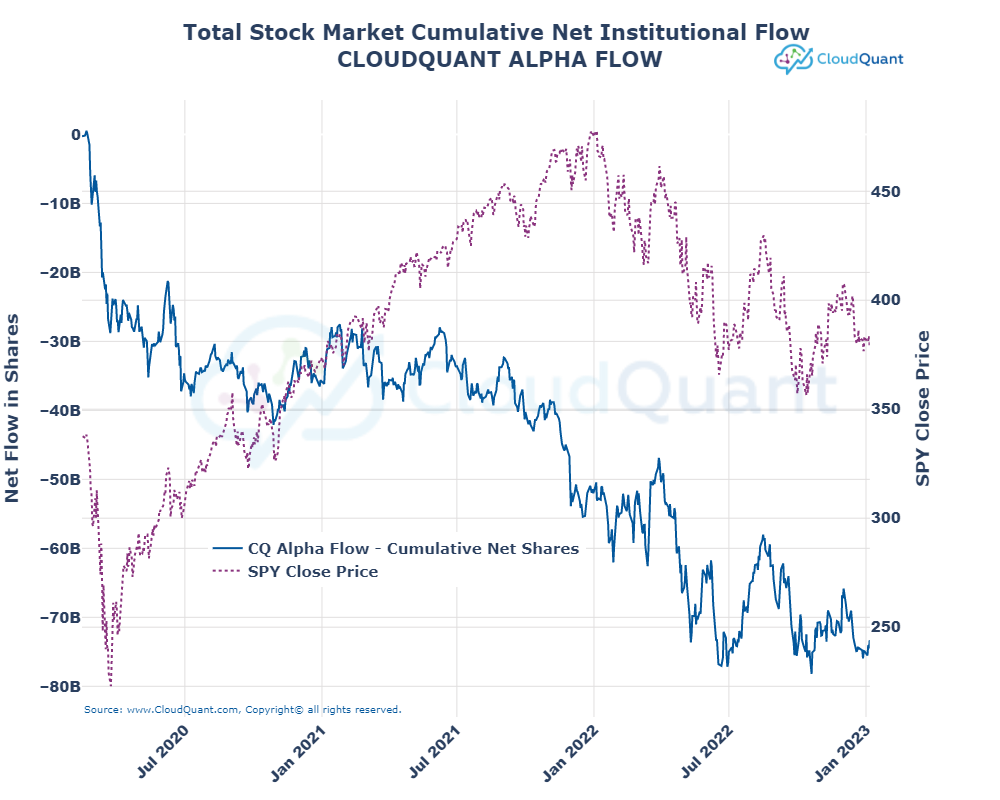

Total Stock Market Net Flow vs. CQ Alpha Flow

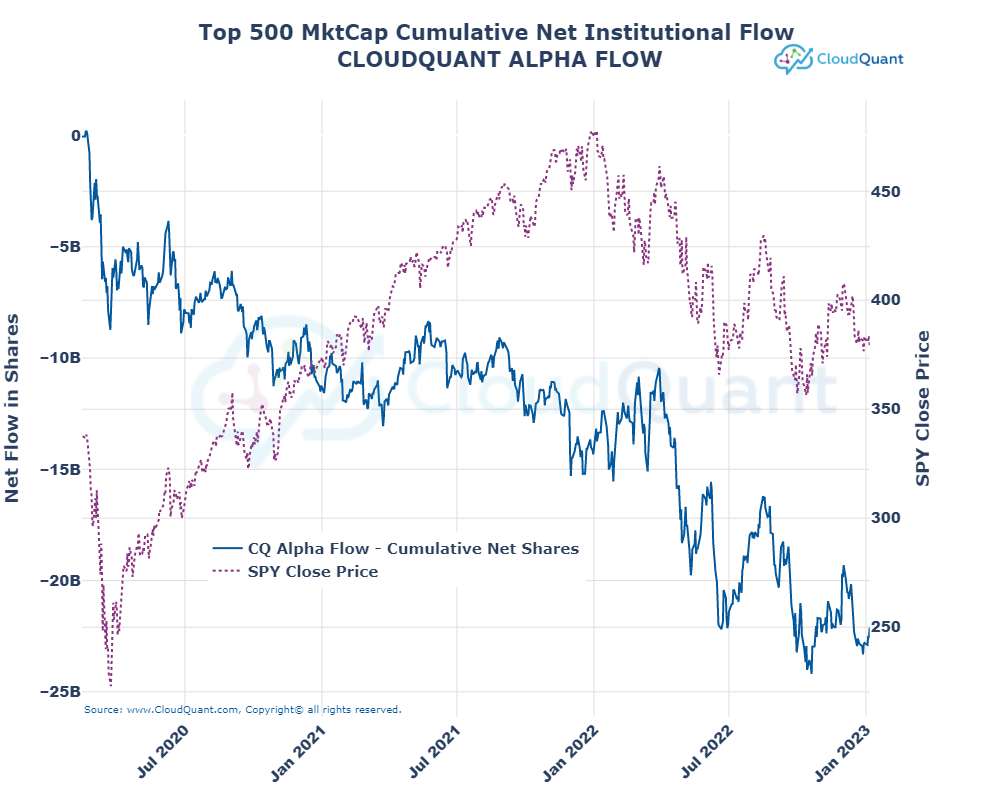

Top 500 Market Cap vs. CQ Alpha Flow

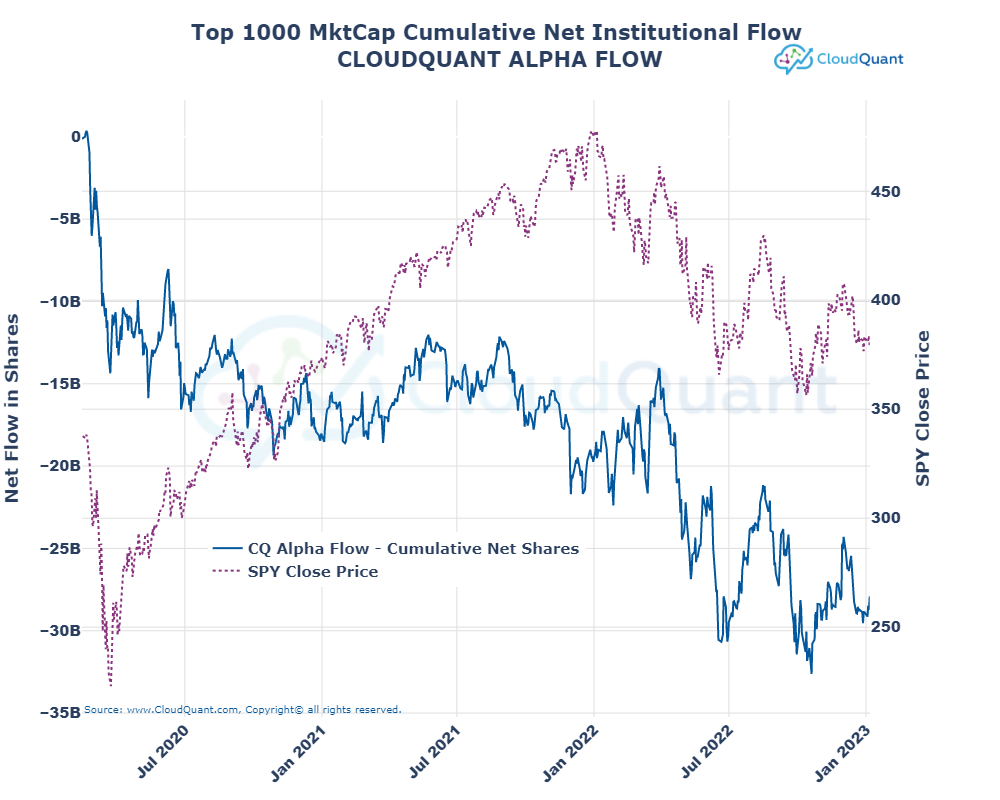

Top 1000 Market Cap vs. CQ Alpha Flow

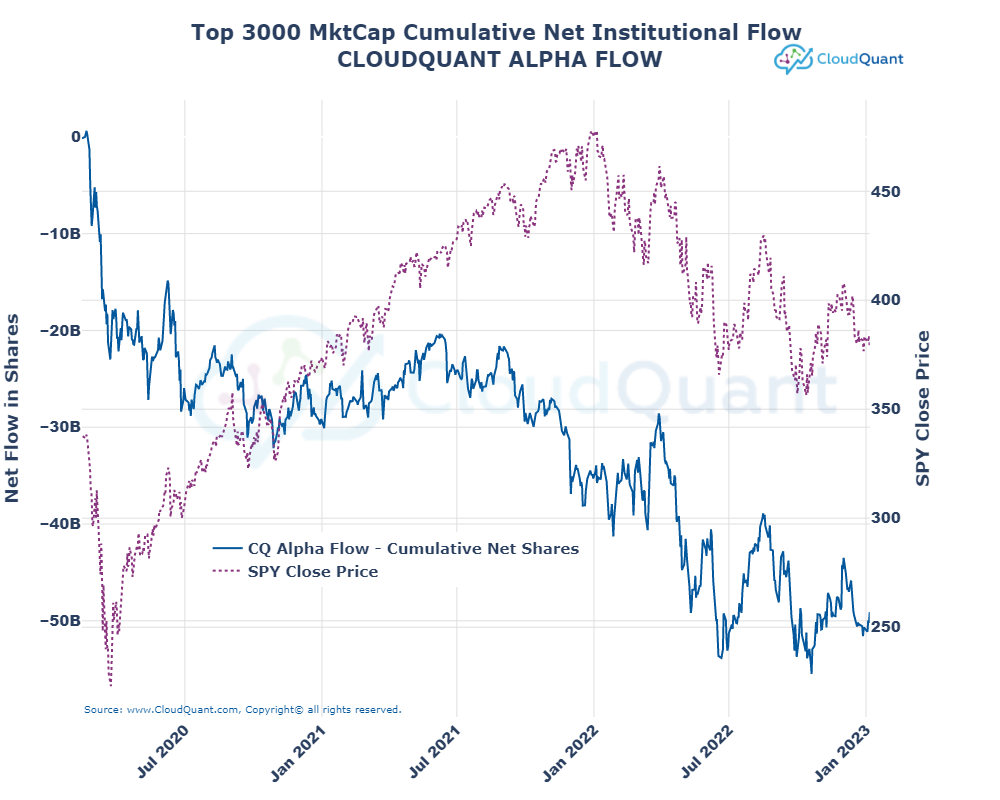

Top 3000 Market Cap vs. CQ Alpha Flow